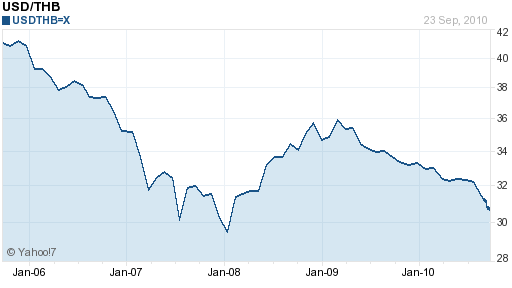

Thai Baht Rises to 13-Year High

As I pack my bags and head to Thailand for a vacation (for forex research purposes…yeah right), I thought it would be appropriate to blog about the Thai Baht’s strength. The momentum behind the Baht has been nothing short of incredible, and as often happens in the forex markets, the currency’s rise is becoming self-fulfilling. It has already appreciated 8.5% over the last year en route to a 13-year high, and some analysts predict that this is just the beginning.

To be sure, the financial crisis exacted a heavy toll on Thai financial markets and the Thai economy. Stock and bond prices lurched downward, as foreign investors moved cash into so-called safe haven currencies, such as the US Dollar and Japanese Yen. However, the Thai economy was among the first to emerge from recession, expanding in 2009, and surging in 2010. “Compared with a year earlier, GDP rose 9.1%, while the economy grew 10.6% in the first half,” according to the most recent data. Tourism, one of the country’s pillar industries, has already recovered, along with exports and consumption. Projected export growth of 27% is expected to drive the economy forward at 7-7.5% in 2010, according to both the IMF and Thai government projections. The consensus is that growth would have been even more spectacular (perhaps 1-2% higher) if not for the politcal protests, which were finally quelled in May of this year.

Anticipation is building that Thailand will use some its reserves to try to halt, or even reverse the appreciation of the Baht. After last week’s intervention by the Bank of Japan, such intervention is now seen not only as being more acceptable, but also more necessary. Due to pressure from the Prime Minister, the Central Bank has convened at least one emergency meeting to determine the best course of action. So far, members can only agree that restrictions on capital flows and lending standards to exporters should be relaxed.

For what it’s worth, Thailand’s richest man has urged the Central Bank not to act: “The effort is likely fruitless as foreign capital is expected to incessantly flood into Thailand because of the country’s healthy economic recovery and export growth. The baht as a matter of fact should become even stronger should Thailand’s politics remain in normal condition.” He is supported by the facts, which show that the Thai export sector has held up just fine in the face of the rising Baht, though perhaps only because other Asian currencies have risen at a comparable pace.

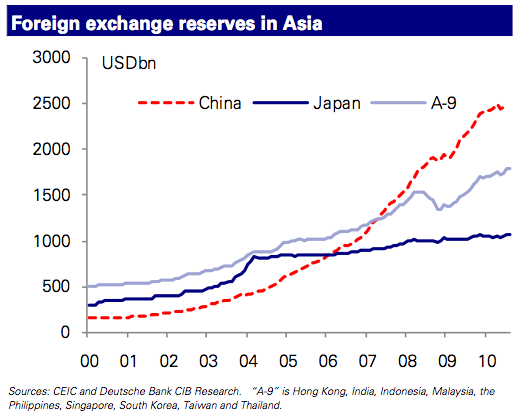

If other Central Banks were to step up their intervention – (Deutsche Bank has argued, via the chart below, that all “Asian central banks have for many years been more or less persistently in the market “stabilizing” their currencies, but with a clear bias towards preventing USD depreciation in this region”) – the Bank of Thailand would probably have no choice but to follow suit.

Periphery Yield Spreads Provide EUR Resistance

The US$ is mixed in the O/N trading session. Currently it is higher against 10 of the 16 most actively traded currencies in a ‘volatile’ trading range.

Yesterdays weekly US claims report brought no joy to the market. The headline print (+465k vs. +453k) interrupted the month long downward trend that analysts note ‘unfortunately occurs at the tail end of the NFP reference period covering the first half of the month’. Continuing claims fell by -48k to +4.489m (a second consecutive weeks decline), straddling the summer long +4.5m print as claims push further into extended and emergency categories. The number of individuals receiving extended and emergency benefits increased +94.1k to +950k and +114k to +4.2m respectively. This has reversed some of the previous week’s declines. Other data was somewhat more upbeat. US leading indicators rose last month more than expected (+0.3% vs. +0.1%), signaling the economy will keep expanding through early next year. Digging deeper, the increase was due to a longer factory workweek, higher stock prices and a gain in building permits. Seven of the 10 sub-categories contributed to the gain while three components weighed on the index, rising jobless claims, a drop in manufacturing supplier deliveries and manufacturers’ orders for consumer goods. Even sales of existing home sales surpassed market expectations (+4.13m vs. +3.84m) and rose from their record lows. However, they are still close to record lows and suggest that the housing market remains depressed one year after economic recovery began. To date, the market has relatively low expectations of housing print headlines due to the glut of inventory, the number or mortgages, high unemployment levels and any one of these variables will take its time to work through the system. The median sales price advanced +0.8% to $179k. Previously owned homes fell -0.6% to +3.98m and at this sales pace, it would take 11.6-months to sell those houses, compared with 12.5m the previous month.

The USD$ is lower against the EUR +0.46%, CHF +0.28% and higher against GBP -0.42% and JPY -0.22%. The commodity currencies are stronger, CAD +0.21% and AUD +0.60%. The loonie continues to trade under pressure as risk aversion strategies dominate. With investors shunning higher yielding assets has pushed the dollar to print a three weeks high yesterday. With retail sales falling more than expected in July and a decelerating inflation print has had the CAD on the back foot this week paring almost 1% of its value. It has been the worst performing of all the major currencies vs. the USD. Mixed US data has dealers reducing their bets that Governor Carney will be raising rates any time soon. The market is beginning to question the ‘true’ strength of the Canadian Economy after the last few data releases coming in much softer than expected. Most of the loonies fall from grace can be attributed to weaker oil prices that are underperforming after the unexpected weekly EIA report earlier in the week. To date the US/CAD spread has dominated he directional play of North American currencies. Month-to-date, spread trades have been the most fundamentally, macro-financial driven reason to want to own the loonie vs. its southern neighbor. A wider spread ‘reflects the improved monetary policy sentiment for Canada’ and is supportive for the currency. With the BOC possibly stepping to the sidelines next month has speculators unwinding some of the CAD long trades in front of the decision. Depending on what commodities are doing, dollar buyers remain on the bid all the way down in the short term.

For a sixth consecutive week the AUD is on top backed by its yield advantage over most of it major trading partners. The spread between 2-year Australian bonds and its US counterpart is near the largest in two years (+442bp). The currency has retreated from its highs as regional bourses see red and profit taking took place. There is a strong difference in monetary policy stance between Australia and the US and it should eventually provide stronger support for the Aussie. Australia is benefiting from its unilateral trade links with the Chinese economy, its largest trade partner. Not helping the currency will be the forming of a minority government. PM Gillard won the backing of key independent lawmakers this month, allowing her Labor Party to retain government and pursue a ‘tax on mining companies’. Technically, ‘the fiscal outlook looks worse under a minority government and management of an economy growing at +10% in nominal-terms may increasingly rest on the RBA’. The problem, a proposed tax on mining companies will dampen demand for the nation’s assets. If we happen to witness global economic growth decelerating, then we could have the reallocation of funds back out of growth currencies just as quickly as it came in. Until recently, the AUD has gained ground against all of its major trading partners as the ‘vix index’ of volatility softens, boosting investor appetite for assets tied to growth. ‘Clearly what happens in the Australian economy is now more dependent upon what happens in China’. Investors are better buyers on deeper pullbacks (0.9545).

Crude is higher in the O/N session ($75.30 +12c). Crude prices ended yesterday under pressure after a surprising weekly EIA report, global bourses seeing red and as the dollar recovered from its weakest level vs. the EUR. Analysts believe that the higher inventories, coupled with the lack of any significant weather patterns in the Gulf of Mexico, are likely to send crude prices lower in the short term. Crude supplies rose +970k barrels to +358.3m. The market had been expecting a shortfall of -1.75m barrels. A weaker dollar generally broadens the investment appeal of commodities. Stocks of gas and distillates (heating oil and diesel) also increased unexpectedly. Gas inventories rose by +1.6m barrels, while distillates rose by +300k barrels. Higher inventory supplies have been the biggest inhibitor for a market advance over the past quarter as stockpiles of oil have recorded the highest levels in 27-years. Hence the divergence somewhat of oil and equity markets of late. The market is wary that the underlying situation has not changed, the overall fundamentals remain weak. Analysts expect speculators to remain better sellers on up-ticks in the short term despite the weakness of the dollar.

Gold has stood tall and ending the week on its highs. Collectively this week it has recorded five record highs and does not seem to in danger of breaking that trend. A concern about a weaker dollar coupled with the sustainable growth issues of the US economy has investors seeking protection in an asset with a ‘store of value’. Any mentioning of projects to keep the currency low will provide stronger support for the commodity. Year-to-date, the yellow metal has appreciated +18.9%, outperforming most of the other asset classes, as global sovereign-debt concerns and an ‘uneven economic recovery roil financial markets’. With the dollar currently trading at new lows vs. the EUR is also aiding commodity prices. Metals are heading for their 10th consecutive annual gain. Global ‘fear’ has the momentum, again, to push speculators back into this overcrowded, one-directional commodity trade. With the Fed on the verge of implementing further QE programs ‘tend to be supportive of asset prices and is fueling concerns about the potential longer-term inflationary affect of such measures’. The opportunity costs of holding gold are low due to falling interest rates, by default, the market should expect better buying of the metal on pull backs ($1,298 +$2.20c).

The Nikkei closed at 9,471 down -95. The DAX index in Europe was at 6,172 down -13; the FTSE (UK) currently is 5,538 -9. The early call for the open of key US indices is higher. The US 10-year backed up 3bp yesterday (2.55%) and is little changed in the O/N session. This week yields have tumbled across the curve especially in the short end. Ten-year product temporarily traded through 2.5% yesterday and two-year product managed to print a record low return after the Fed’s statement earlier in the week. Policy makers are willing to ease monetary policy to try to boost the US economy and employment. The curve has flattened to its narrowest point in two-weeks (+211bp). Further risk of economic relapse is providing the bid for debt despite the mixed data from claims and existing home sales yesterday. The market can expect treasuries to trade within a tight range short term.

Aucun commentaire:

Enregistrer un commentaire